are donations to election campaigns tax deductible

Individual donations to political campaigns. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

The Complete Political Fundraising 2022 Guide Numero Blog

These business contributions to the political organizations are not tax-deductible just like the individual.

. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political.

Money donated to political campaigns or any aspect related to these campaigns and politics generally is not applicable for tax deductions. Regardless of what type of political. The following materials discuss the federal tax rules that apply to political campaign intervention by tax-exempt organizations.

Resources for charities churches and. Only those donations or contributions that have been utilizedspent during the campaign period as set by the comelec are exempt from donors tax. Theyre given to an organisation with deductible gift recipient DGR status - note.

Money given to the Brady Center is tax-deductible and will go to combating crime guns helping our legal team fight for justice and promoting our public health and safety. These limits are set by the Federal. Note that even though political donations are not tax deductible the IRS still limits how much money you can contribute for political purposes.

Individuals may donate up to 2900. The contribution refund program was created because contributions to municipal election campaigns are not tax deductible. The most you can claim in an income year is.

To be precise the answer to this question is simply no. The answer is no donations to. However political contributions and tax deductions are.

To put it another way financial donations to political campaigns are not tax deductible. Any payment contributions or donations to political groups or campaigns are not tax-deductible. While contributions to political causes campaigns and people are not tax deductible there are limits on how much you can donate.

Able to receive donations and contributions but these charitable contributions are no longer deductible to the taxpayer since 501c3 status is lost. Limits on Political Contributions. So for example if you donate to a political party candidate or even a political.

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Government By The People Ppt Download

Why Political Contributions Are Not Tax Deductible

Joint Fundraiser Disclaimer Example

Tax Deductions For Donating To A University

Rethinking The Presidential Election Campaign Fund Tax Policy Center

A Quick Guide To Deducting Your Donations Charity Navigator

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

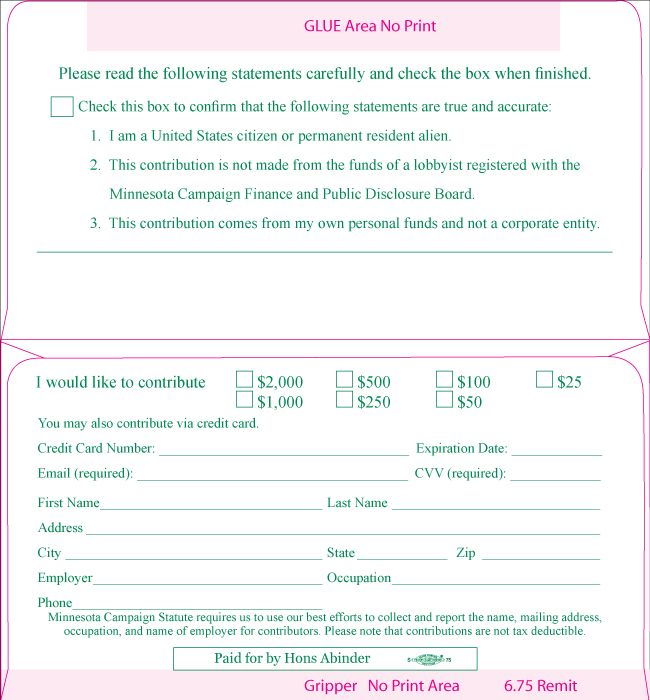

Political Remit Envelops St Paul Minnesota Union Local

From 25 To 10 000 000 A Guide To Political Donations Campaign Finance Election 2012 Nytimes Com

Fec Candidate Who Can And Can T Contribute

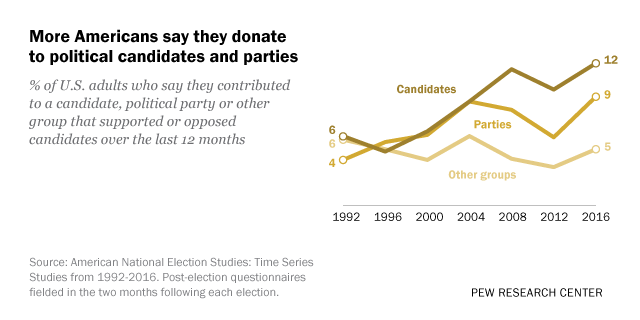

5 Facts About U S Political Donations Pew Research Center

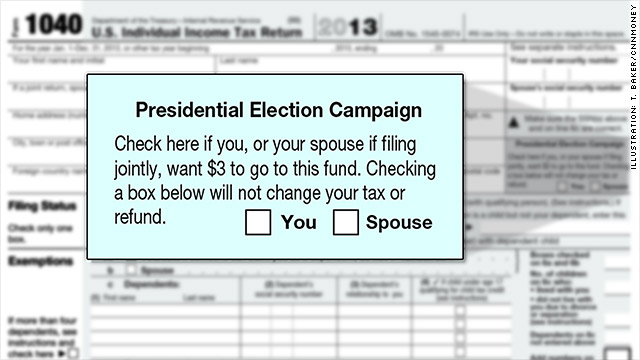

The Real Story Behind The 3 Tax Checkoff Box

Donation To Political Party Sections 80ggc And 80ggb Tax Deductions

Limits And Tax Treatment Of Political Contributions Spencer Law Firm

Are Campaign Donations Tax Deductible Priortax

Corporate Donors Gave 44 Million To Election Deniers Campaigns Mother Jones